s corp estimated tax calculator

May be individuals certain trusts and estates and. Partner with Aprio to claim valuable RD tax credits with confidence.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator - S Corp vs LLC Savings.

. Who Must Pay Estimated Tax. Corporations use the LLC tax rate calculator to determine taxes. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed.

PAyroll taxes paid as an s-corporation With a salary of and a. The following January 15. Consider additional taxes such as employment payroll self-employment tax federal income tax and accumulated earnings tax.

C-Corp or LLC making 8832 election. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Ad With TurboTax You Can Do It Yourself Or w Self-Employed Expert Help To File Confidently.

This calculator helps you estimate your potential savings. Based On Circumstances You May Already Qualify For Tax Relief. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000.

This page and calculator are not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Have only allowable shareholders.

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. Be a domestic corporation. We are not the biggest firm but we will work with you hand-in-hand.

Normally these taxes are withheld by your employer. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. This saves you from having to submit payments yourself.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. To qualify for S corporation status the corporation must meet the following requirements. Youre guaranteed only one deduction here effectively making your Self-Employment tax 1413 or 7065.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. Partnership Sole Proprietorship LLC.

Annual state LLC S-Corp registration fees. Estimated Local Business tax. Sometimes an S corporation must make estimated tax payments.

S-Corp or LLC making 2553 election. This results in the same amount of money being set aside without you having to do anything. Our S corp tax calculator will estimate whether electing an S corp will result in a tax.

Estimated payments are portioned into four payment intervals throughout the year. Income for January 1 through March 31. Corporations generally have to make estimated tax payments if they expect to owe tax of 500 or more when their.

Income for April 1 to May 31. Now if 50 of those 75 in expenses was related to meals and. Annual cost of administering a payroll.

From the authors of Limited Liability Companies for Dummies. For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by 200 on your biweekly payroll. Total first year cost of S-Corp administration.

Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. Income from September 1 to December 31. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Estimated Local Business tax. Tax on built-in gains Excess. Income for June 1 to August 31.

Taxes vary depending on the business entity. S corporations are responsible for tax on certain built-in gains and passive income at the entity level. Generally an S corporation must make installment payments of estimated tax for the following taxes if the total of these taxes is 500 or more.

Look up the taxes due from the tables in the previous years instructions. Now if 50 of those 75 in expenses was related to meals and. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes.

Check each option youd like to calculate for. Estimate your corporations taxes with Form 1120 or using the taxable income of last year. Forming an S-corporation can help save taxes.

Compare this to income taxation for this person at 5235 without deductions taken. Use Publication 15-T to determine the amount of federal income tax to withhold.

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

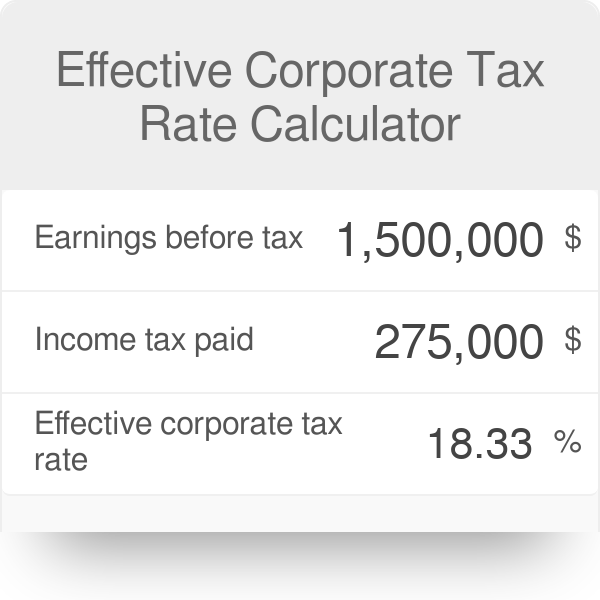

Effective Corporate Tax Rate Calculator

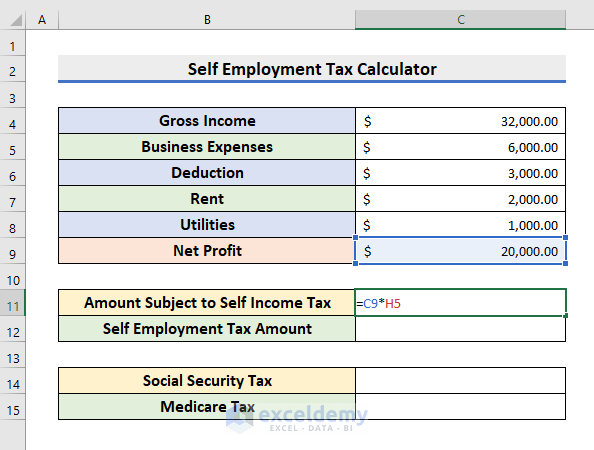

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Salehaamir322 I Will Provide Swedish Tax Consulting For 60 On Fiverr Com Tax Consulting Consulting Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Moneysmarts 3 Things To Do With Your Tax Refund This Year The Werk Life Tax Refund Money Saving Tips Saving Money

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Fillable Form 1040 Schedule E 2019 Schedule Fillable Forms Tax Forms

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Quarterly Tax Calculator Calculate Estimated Taxes

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Preparation Services Shares More About Taxes Hit The Like Repin Button If You Don T Mind Retirement Savings Plan Budget Planner How To Plan

Income Tax Preparation Video Income Tax Preparation Llc Taxes Capital Gains Tax

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

October 15 Extended Tax Filing Deadline Tax Time Filing Taxes Tax Season