child tax credit october 2021 delay

After that families will only get two more checks this year with the rest of the credit coming during tax season next. This will result in about a 10 to 13 reduction per child in the three remaining monthly payments.

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

IRSnews IRSnews October 15 2021 Why havent I received my Child Tax Credit payment There are several reasons why you may have not received a your October child tax credit payment.

. The deadline for the next payment was October 4. Revision Date Posted Date. He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day.

Self-Employment Tax Return Including the Additional Child Tax Credit for Bona. The IRS on Friday release declared that due to a technical issue the payments for the last month got delayed for a small number of advance child tax credit recipients in September has now been sorted while explaining about the fourth monthly payments of the program. Most of the millions of Americans.

September 28 2021 1027 AM MoneyWatch Some US. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check.

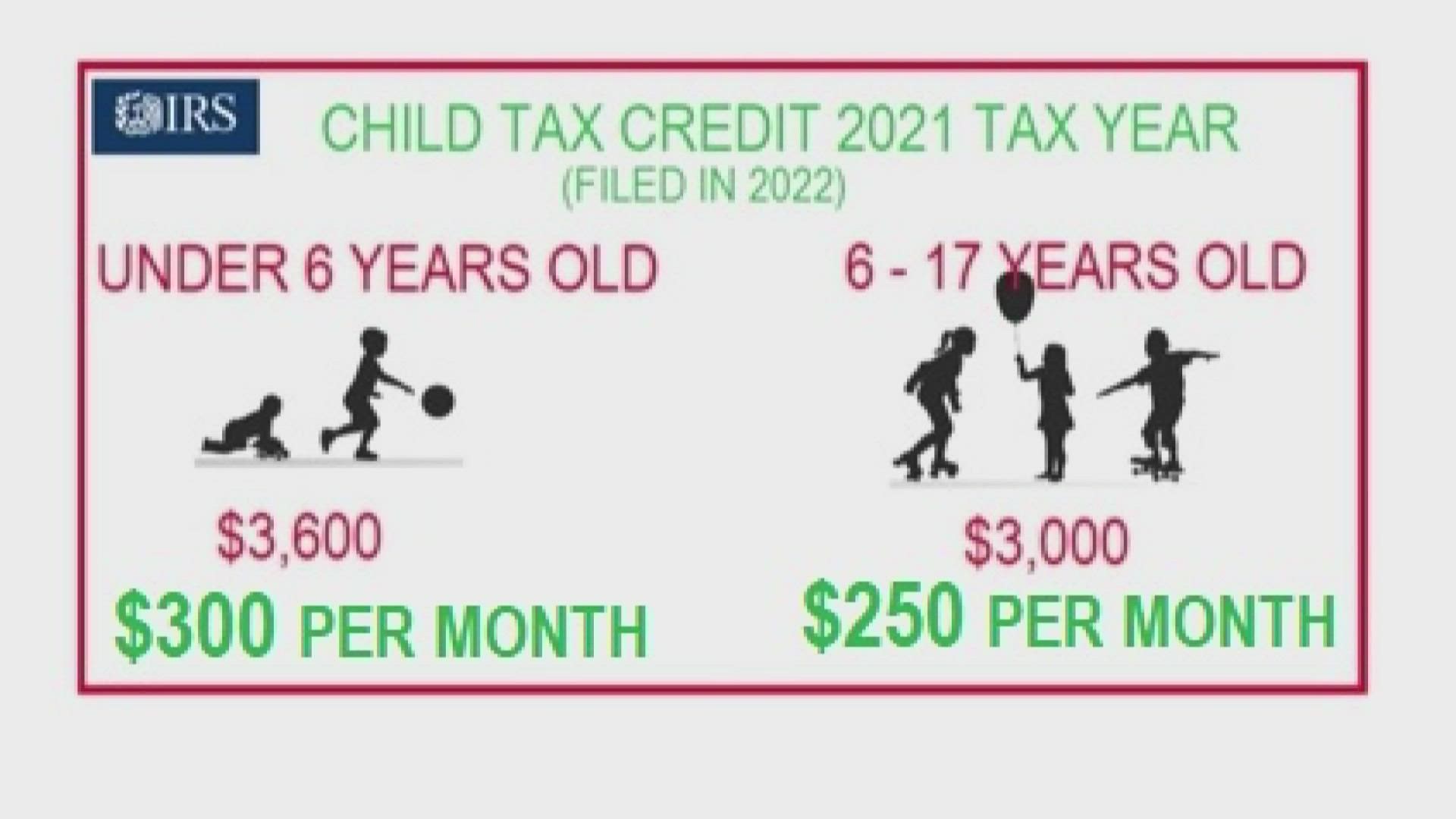

Those with children ages 6 to 17 can expect 250 per child. Wait 10 working days from the payment date to contact us. 1st Apr 2022 1300.

October 14 2021 726 AM MoneyWatch The fourth monthly payment of the enhanced Child Tax Credit landed in bank accounts Friday with anti-poverty researchers pointing to the ongoing cash. The credit will increase from 2000 for children under the age of 17 in 2020 to 3600 for children under the age of 6 and 3000 for children aged 6 to 17 in 2021. 906 ET Sep 15 2021.

Child Tax Credit 2022 02242022 Publ 972 SP Child Tax Credit Spanish Version 2022 02252022 Form 1040-SS. Parents eagerly expecting their third enhanced Child Tax Credit payment last week say they experienced a delay in getting the money as expected. Those impacted by the reductions will receive a letter from the IRS.

26102021 - 1823 he IRS started sending out the fourth lot of Child Tax Credit payments on October 15 and millions will have already received this money either via direct deposit or by mail. The typical overpayment was 3125 per child between 6 and 17 years old and 3750 per child under 6 years old. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments.

2021 tax returns when you file your taxes in early 2022. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. Individuals earning less than 75000 and married couples earning.

This will result in about a 10 to 13 reduction per child in the three remaining. The phaseout range for the basic 2000 child tax credit for 2021 starts at a modified adjusted gross income of 400000 for married filing jointly and 200000 for other filers. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old.

IR-2021-201 October 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. For those couples each spouse will receive slightly less in their October November and December checks to compensate for the overpayment on average 10 to 13 per child.

Sarah TewCNET In just two days the next child tax credit payment is scheduled to arrive in millions of eligible parents bank accounts. Families with children under 6 years old will receive 300 per child. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates.

Around 60 million eligible families were expected to receive the credit via direct deposit this morning while those who opted to receive. October 16 2021. Will be disbursed on these dates.

The IRS is planning to issue three more monthly payments this year. The 2021 advance monthly child tax credit payments started automatically in July. The IRS tax deadline for 2021 returns is April 18 for most states.

March 10 2022. Two more child tax credit. It also lets recipients unenroll from advance payments in favor of a one-time credit when filing their 2021 taxes.

Although there are some similarities the child tax credit in 2021 differs dramatically from the allowance in 2020. Child Tax Credits land in families. Child Tax Credits if youre responsible for one child or more - how much you get eligibility claim tax credits.

October 5 2022 Havent received your payment. Child Tax Credit payments and Recovery Rebate Credits can make delay refunds. PARENTS are voicing their anger on social media as they havent yet received their third installment of the enhanced Child Tax Credit - despite payments being sent out today.

907 ET Sep 15 2021. The next Advanced Child Tax payment is due to go out on October 15th.

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund

Child Tax Credit Delayed How To Track Your November Payment Marca

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

Deadline To Apply For 2021 Child Tax Credit Is Monday

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Final Advance Ctc Payments Have Begun Irs Says Accounting Today

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

When Parents Can Expect Their Next Child Tax Credit Payment

Did Your Advance Child Tax Credit Payment End Or Change Tas

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com